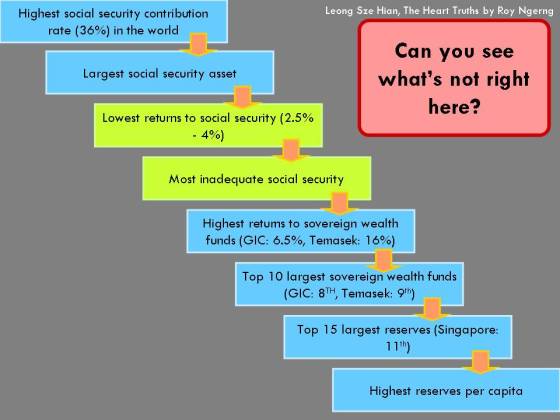

In the first part of this article, we shared with you that Singaporeans pay the highest proportionate contribution into social security (which is our CPF) in the world – the 36% we pay is the highest in the world. Singaporeans are also one of the only 12 countries, or 7% out of 166 territories, where employees pay more than employers into social security. (You can read Part 1 of this article here.)

In the first part of this article, we shared with you that Singaporeans pay the highest proportionate contribution into social security (which is our CPF) in the world – the 36% we pay is the highest in the world. Singaporeans are also one of the only 12 countries, or 7% out of 166 territories, where employees pay more than employers into social security. (You can read Part 1 of this article here.)

However, even though Singaporeans contribute the most into our CPF, and accumulate the largest CPF assets, we have the one of the least adequate retirement funds in the world. But why is this so?

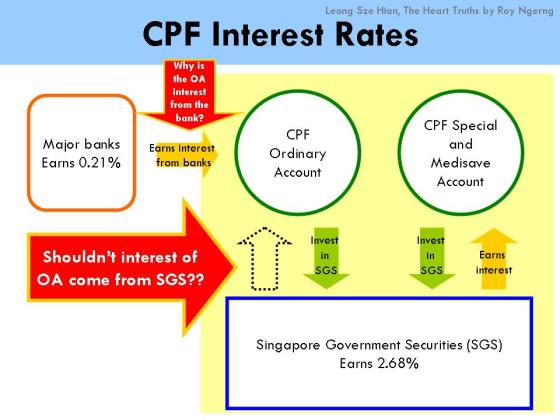

This is because we are paid very low returns on our CPF. We are paid only 2.5% on the Ordinary Account and 4% on the Special and Retirement Accounts (Chart 1).

Chart 1: Interest Rates

According to the CPF Board, the 2.5% interest for our Ordinary Account (OA) is based on the interest rates of the major local banks, which was last at 0.21%. And because the CPF Board is required to pay us a minimum of 2.5% on our CPF, the interest on the OA has remained at 2.5%.

For the interest for our Special and Medisave Account (SMA), it is based on the interest that the bonds (Singapore Government Securities (10YSGS)) that our CPF is invested in earns, plus another 1%. So, because the bonds are earning 2.68%, and the minimum our SMA has to earn is 4%, our SMA will continue to earn a 4% interest rate.

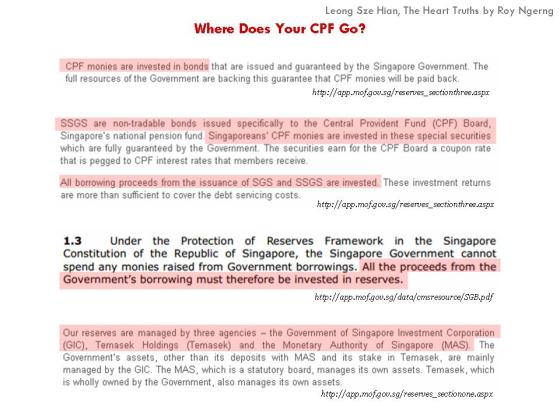

However, why is there a discrepancy in the interest earned on our OA and SMA? In fact, do you know that according to the Ministry of Finance, our “CPF monies are invested in bonds that are issued and guaranteed by the Singapore Government“. So, if that’s the case, if our OA is also invested in the bonds, why is the interest rate on our OA pegged to that of the the major local banks? Shouldn’t it be pegged to the bonds that our CPF are invested in? If so, shouldn’t our OA and SMA earn the same interest rates of 4% (Chart 2)?

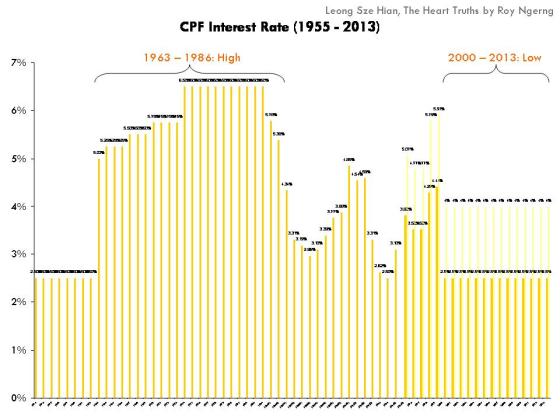

And do you know that it was only in 1995 that our OA and SMA started earning different interest rates? Before that, our total CPF would earn the same interest rate (see Chart 16).

Chart 2

But that’s not even the problem. Do you know where our CPF is really, really invested in? Take a look at Chart 3 and looked at the pink shaded parts.

Chart 3

So, our CPF is indeed invested in the GIC and Temasek Holdings! But more importantly, do you know how much interest the GIC and Temasek Holdings are earning?

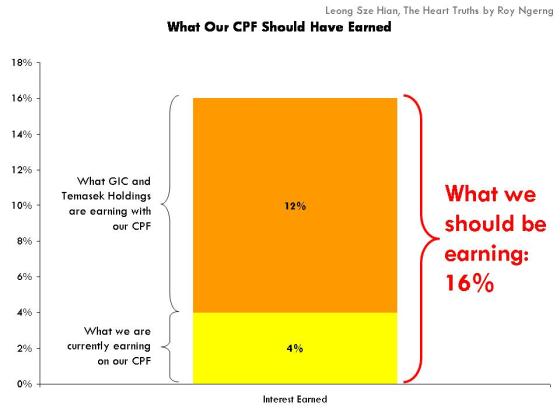

GIC earns an interest of 6.5% (Chart 4).

Chart 4: Ministry of Finance: Section I: What comprises the reserves and who manages them?

Temasek Holdings earns an interest of 16% (Chart 5).

Chart 5: Temasek Review 2013

And if so, if our CPF is invested in the GIC and Temasek Holdings, and they are earning interest of between 6.5% to 16%, why are we earning only 2.5% to 4%? Shouldn’t we be earning 16% (Chart 6)?

Chart 6

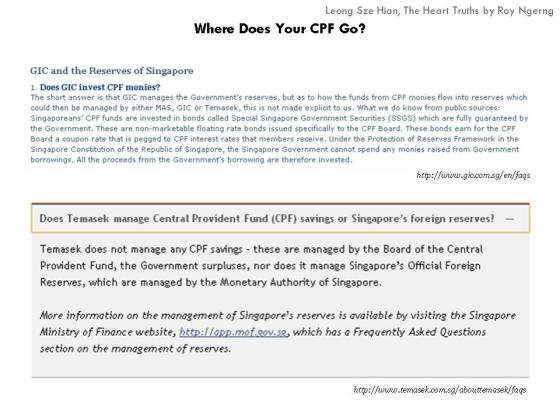

The question is also, why do the Temasek Holdings and GIC, as government agencies, continuously deny that they are using our CPF for investments (Chart 7)? As the largest government investment firm in Singapore, can the GIC really claim ignorance as to where the monies that they manage of Singaporeans come from?

Chart 7

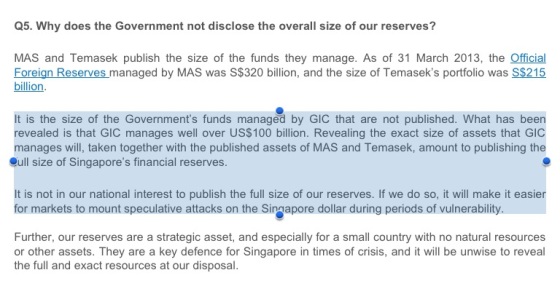

Not only that, do you know that the government has said that they do not want to reveal the “exact size of assets that GIC manages” because “if we do so, it will make it easier for markets to mount speculative attacks on the Singapore dollar during periods of vulnerability” (Chart 8).

Chart 8: Ministry of Finance Singapore Section I: What comprises the reserves and who manages them?

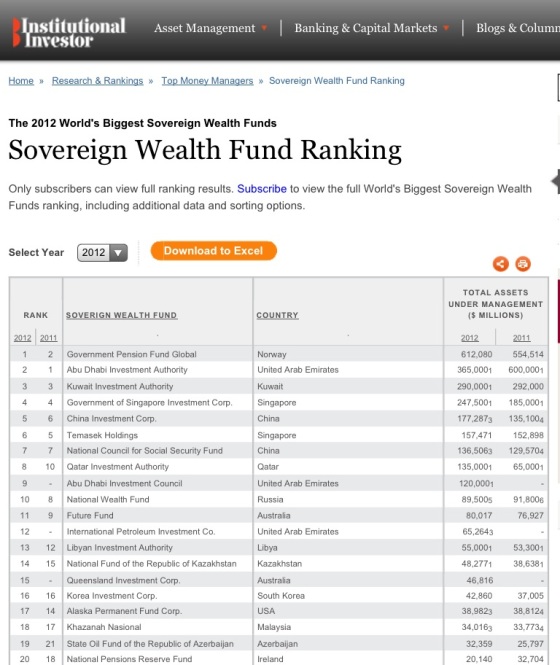

But then do you know that the size of GIC’s assets can be found readily available on several websites? It can be found on Institutional Investor (Chart 9).

Chart 9: Institutional Investor

It can be found on Sovereign Wealth Funds News.com (Chart 10).

Chart 10: Sovereign Wealth Funds News.com

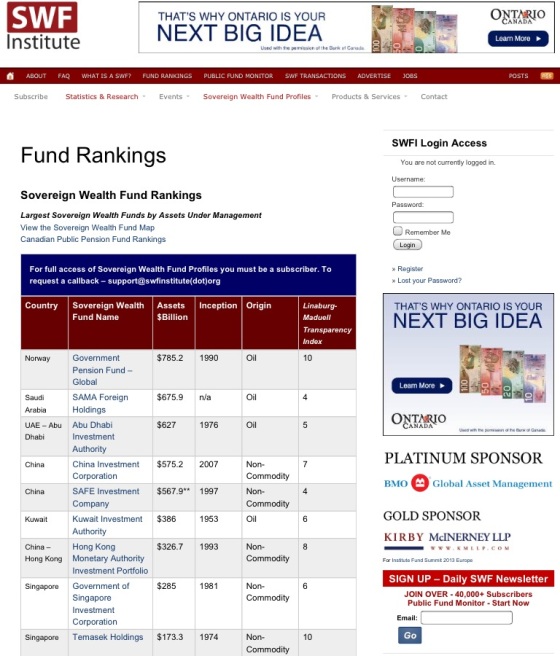

On Sovereign Wealth Fund Institute as well (Chart 11).

Chart 11: Sovereign Wealth Fund Institute

And on Global Finance too (Chart 12).

Chart 12: Global Finance

So, you see, the information is everywhere. Then, the question is – if the government already allows other people to know this information so readily already, then why does it want to tell Singaporeans that it is not in our interests to let Singaporeans know how much GIC is earning (from us)?

And if you look at the Global Finance website, it says that, “sovereign wealth funds … are pools of money governments use to generate profits”. Then if so, why aren’t Singaporeans seeing these profits??

Do you know that together with the assets that the Monetary Authority of Singapore and Temasek Holdings manage, our reserves would stand at at least S$900 billion – or close to S$1 trillion (Chart 13)!!

Chart 13

And if there are S$1 trillion in the Singapore reserves, then why the heck are Singaporeans earning one of the lowest returns to our CPF? Why do Singaporeans still live on one of the least adequate pension funds? Why do most Singaporeans still have to work past their retirement – the highest in the region – because they cannot afford to retire? (Read Part 1 here for how inadequate our CPF is).

If the Singapore government is so rich, why do Singaporeans continue to earn the lowest salaries among the high-income? Why does the government continue to spend the lowest on health among the developed countries and one of the lowest in the world? Why does the government continue to spend the lowest on education among the developed countries? Why does the government continue to spend the least public spending, such that Singapore now has the highest income inequality among the high income countries, and one of the highest in the world? Why is there still no minimum wage in Singapore to protect the low-income earners in Singapore and why do we have the highest poverty rate among the high income countries?

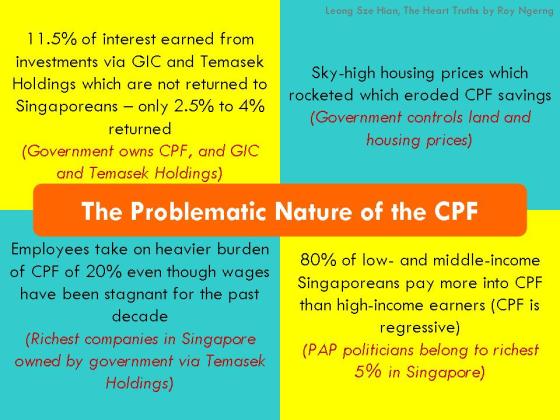

Singaporeans Are Paying An Implicit Tax On CPF

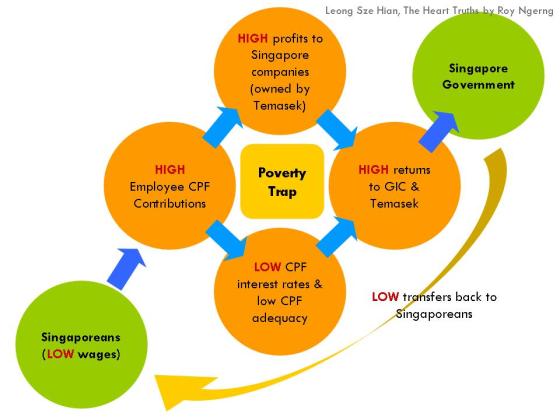

According to the Asian Development Bank Institute, “To the extent the Government earns a higher rate of return on the CPF funds than what it pays to members; there is an implicit tax on CPF wealth. This tax is likely to be fairly large and regressive, as low-income members are likely to have most of their non-housing wealth in the form of CPF balances. This vividly illustrates how political risks (i.e protection of political power) and non-transparency can arise in an individual account system.”

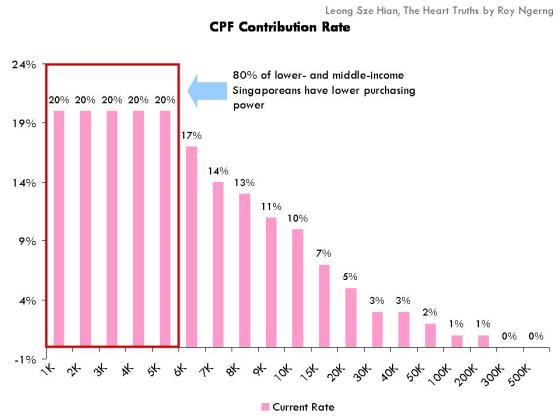

Already, the contribution rate that we are paying into CPF is regressive, as the lower-income Singaporeans pay a higher proportion of their incomes into CPF than the higher-income earners (Chart 14). In fact, nearly 80% of the lower- and middle-income Singaporeans pay more into their CPF, than the higher-income earners.

Chart 14: The Heart Truths

There are real problems with continuing with the current model of the CPF, as the Asian Development Bank Institute had also asked, “How valuable is the guarantee of 2.5 percent nominal return? As the long-term annual inflation rate in Singapore is about 3.0 percent, the guarantee does not even preserve the principal in real terms.”

Indeed, you can see that over the past few years, the inflation rate has been rising (red line), and has become higher than the returns to our CPF (blue line) (Chart 15).

Chart 15: Annual Consumer Price Index and Inflation Rate

Not only that, do you know how much interest the other countries with social security are earning?

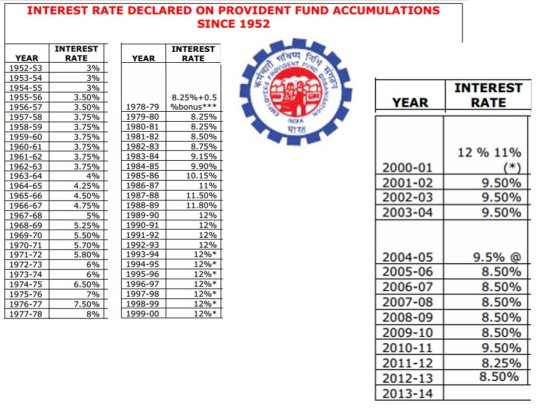

This is what India is earning – between 8% and 10% in recent years (Chart 16).

Chart 16: Interest Rate Declared on Provident Fund Accumulations Since 1952

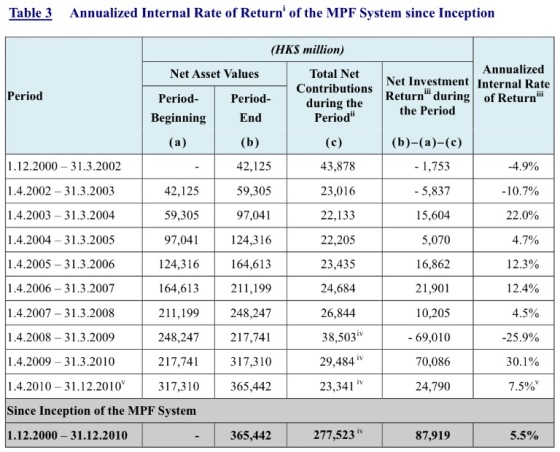

This is what Hong Kong is earning (Chart 17). Note that, “as a whole, the MPF System recorded an annualized return of 5.5% over the 10-year period after fees and charges”, which is still significantly higher than the 2.5% and 4% on our CPF. It also “outperform(ed) the average annual inflation rate (0.7% per year) and the one-month HK dollar deposit rate (1.0% per year) of the same period“.

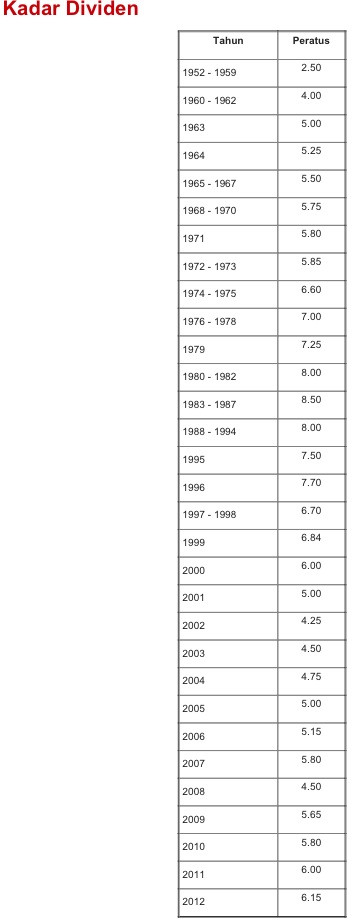

This is what Malaysia is earning – between 4.5% and 6.5% in recent years (Chart 18).

Chart 18: Employees Provident Fund Dividend Rate

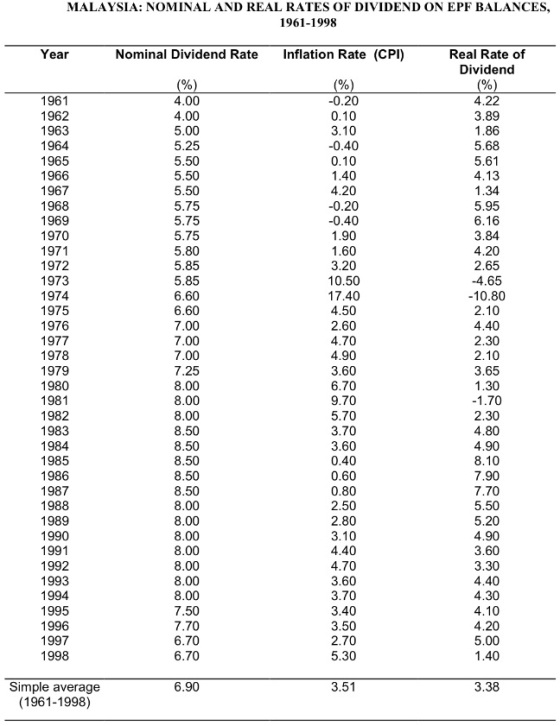

And if you look at what the Malaysians are earning, even after accounting for inflation, it is still higher than what Singaporeans are able to get back (Chart 19).

Chart 19: South East Asian Provident and Pension Funds: Investment Policies and Performance

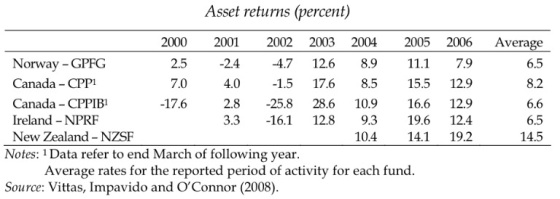

And finally, here’s a look at how Norway, Ireland, Canada and New Zealand did – between 6.5% and 14.5% (Chart 20).

Interestingly, between 1970 and 1995, Singapore had also underperformed the other countries (Chart 21).

Chart 21: Investment of Mandatory Funded Pension Schemes

But do you know that we didn’t use to always earn such a low interest? You can see in Chart 22 that during the earlier years of Singapore until the mid-1980s, Singaporeans were enjoying better returns on our CPF. The government used to protect Singaporeans.

Chart 22: Investment Patterns in Singapore’s Central Provident Fund System

Thus, in order to ameliorate the CPF’s pitfalls, the Asian Development Bank Institute had recommended that, “urgent consideration should be given to eliminating the implicit tax on CPF wealth (whereby the government returns us only 2.5% to 4% and keeps the other 2% to 11.5% that our CPF earns for themselves). This can be accomplished by crediting the weighted average of returns of government investment companies, which are actually making decisions on the deployment of the CPF funds. Similarly, full returns must be credited to the Government Pension Fund, and other provident and pension funds.”

Thus it is precisely because the Singapore government mandates the fixed interest rates for our CPF, and does not channel the full returns from our CPF back to us (by indirectly taxing us on our CPF monies), Singaporeans have the least adequate retirement funds among the developed countries and with the countries in the region.

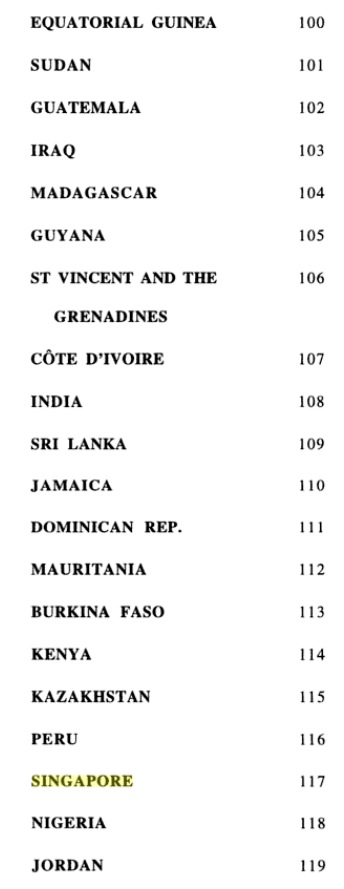

Indeed, in a ranking of social security systems in 1995, Singapore was ranked 117th out of 172 countries (Chart 23). If Singapore was already performing so badly then, you can imagine how much worse Singapore would perform now. The report explained that the reason why Singapore was ranked so poorly at 117th is because “of its chosen financial arrangements, which sought to achieve objectives other than those related to social security.”

Chart 23: Social Security in Global Perspective

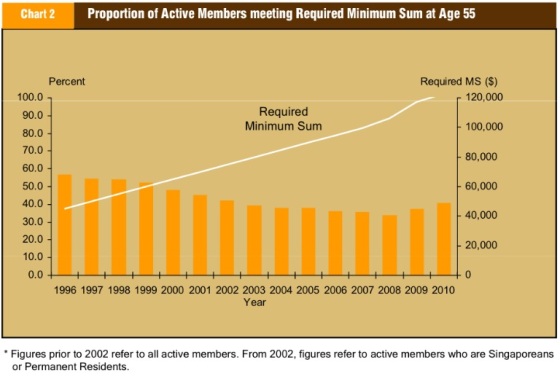

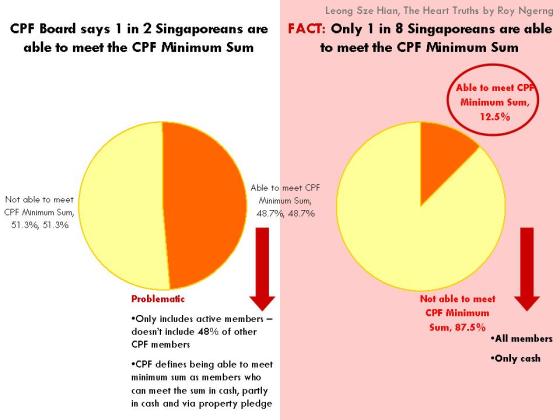

Thus it is no wonder that fewer and fewer Singaporeans have been able to meet the minimum sum required to be set aside in the CPF. Barely 40% of Singaporeans are able to meet the minimum sum in 2010. According to the CPF Board, in 2012, 48.7% of Singaporeans were able to meet the minimum sum. This is still lower than the 57% who were able to do so in 1996 (Chart 24).

Chart 24: CPF Trends Minimum Sum Scheme

However, if you look deeper into the statistics, the actual proportion of Singaporeans who are really able to meet the CPF minimum sum would be even lower. The 40% of Singaporeans who are able to meet their minimum sum accounts only for active members. The 1,788,768 active members accounts for only 52% of the total 3,418,569 CPF membership. However, the qualification of those who can meet the minimum sum include those who can meet the sum “fully in cash, or partly in cash and partly via a property pledge“. Does it make sense to include property pledges in the minimum sum – would you have to sell your home to have cash to retire?

So, what this means is that, if we include the “non-active” members who are able to meet their minimum sum, solely on the basis of cash (and not including property which cannot be monetised with selling it), we estimate that the proportion of Singaporeans who can actually meet the CPF minimum sum would only be about 1 in 8 of Singaporeans (Chart 25).

Chart 25: Only 1 in 8 Singaporeans are able to meet the CPF Minimum Sum

The Asian Development Bank Institute had also said that, “Singapore’s method of investing the balances meant for retirement financing is contrary to best international practices concerning pension fund management, and have the potential to generate high political risk. Such concentration of savings in the hands of non-transparent, non-accountable agencies (i.e. GIC and Temasek Holdings) also distorts the savings investment process and could lead to inefficiencies in the structure of asset returns. The development of the financial and capital market may also be adversely affected due to such concentration on savings, and due to the use of CPF as a substitute for mortgage financing. The method, however, is consistent with Singapore’s monocentric power structure, and strong tendency towards social engineering and control.”

The Asian Development Bank Institute had also outlined the major flaws of the CPF, which we have tried to explain in further detail in this article, such as the “inadequate balances at retirement due to extensive pre-retirement withdrawals, particularly for housing and property, and due to low returns credited to members; lack of inflation and longevity protection; lack of survivors’ benefits; lack of transparency and accountability, particularly in investment management; inadequate weight given to fiduciary responsibility as compared to socio-economic engineering objectives; inadequate social risk pooling in health care financing (only about a quarter of the total national health budget comes from the Government – the rest is from individual and businesses, while the opposite can be seen in high income countries of the OECD); and the virtual absence of a tax-financed redistributive tier.”

The Asian Development Bank Institute also recommends that Singapore needs to, “reform the governance structure of the CPF focusing on ending the implicit tax on the CPF and making CPF-related data a public good by making disaggregated data freely available. The CPF board needs to be more independent and accountable to members.”

This is echoed by the National University of Singapore which had recommended that, the “investment policies and performance of the CPF Authority should be completely transparent, and de-linked from the government holding companies. All investments, wherever feasible, should be mark-to-market.” Also, “all returns on investment must be made known and go directly to the members’ individual accounts”.

In sum, you can look at Chart 26 to see why the CPF system is highly problematic.

Chart 26

In effect, even though Singapore has an apparent low tax rate of 0% to 20%, this needs to be put in clearer perspective with the high CPF contribution rate 20%, which is the highest in the world. Also, the government has long used the rationale that because of the low tax rate, government spending has to remain low. Indeed, the Singapore government spends the lowest public spending among the developed countries. However, when you understand how we are actually paying a higher proportion of our incomes into CPF, which has created a massive pool of CPF monies – possibly the largest per capita social security fund in the world, but where we are receiving one of the lowest returns, if not the lowest in the world, you will understand that the CPF is effectively a tool created to efficiently take money from the people for the government’s own investment, without giving the full returns back. Compare this with tax, where the government is obliged to return the tax deducted from the people back to the people, in ways of expenditure.

Chart 27

To put things into perspective, look at the chart below. Do you see what is not right?

Chart 28

What’s really happening is that the CPF has become one of the tools to entrap Singaporeans in a cycle of poverty (Chart 29).

Chart 29

Finally, the Asian Development Bank Institute sends out a stern warning to the PAP government that, “Singapore policymakers face a stark choice. Either they can continue to use the CPF for socio-political control and engineering, or they can bring its objectives and governance in line with international best practices, to improve the return accruing to members, and to make a greater proportion of CPF contributions available for retirement needs. The choice is politically difficult, but it is unavoidable given the objective realities.” Most importantly, ”It should be stressed that the reforms will also require an increase in the Government’s budgetary allocations as well as total national expenditure devoted to social security and health care.”

You can read Part 1 of this article here.

Leong Sze Hian and Roy Ngerng of The Heart Truths