TR Emeritus

26 May 2014

http://www.tremeritus.com/2014/05/26/leong-money-in-your-cpf-account-is-your-money/

We refer to the article “‘Money in CPF account is your money’: Tan Chuan-Jin” (Straits Times, May 26).

“Money in your CPF account is your money”?

It states that “”Money in your CPF account is your money””.

We want transparency and accountability for our CPF?

– Since the “money in your CPF is your money” – Why is it that the excess returns that may be derived from the use and/or investing of CPF money, all these years, not returned to us?

Why is there no transparency and accountability as to the exact paper trail as to what happens to our CPF?

Where does and has it gone to?

What returns were generated?

Where exactly are our CPF – in the Reserves – all of it in the Reserves and where exactly in which entities or funds of the Reserves?

Who exactly are or have been managing our CPF money?

What expenses (total expense ratio) are we and have we been paying on our CPF money?

Lowest real rate of return in the world?

Are there any countries in the world that do what our CPF system does? – Are we historically, the national pension fund that pays or have been paying the lowest real rate of return in the world?

In respect of “And that is why we pay an extra interest of 1% for the first $60,000 of CPF savings of every Singaporean so that those with lower balances can grow their savings faster. We also raised the amount that employers must contribute to CPF recently, especially for older workers and lower-wage workers”

– What is the overall average rate of interest on all the different CPF accounts (OA, SA, Medisave, RA) – about 3 plus %?

CPF helps you pay for housing and healthcare?

As to “Apart from retirement, CPF savings have helped Singaporeans own homes and cover healthcare expenses, said Mr Tan. “Many of us are already using our CPF monies to fund expenses that would otherwise have come from our disposable income.”

Most expensive public housing in the world?

– With arguably the most expensive public housing in the world (using the ratio of price to income) – what are the implications for Singaporeans for their CPF and their retirement?

In this connection, as to “But there are several schemes to help them if they wish to get cash from their homes. Besides renting out rooms, which many do, they can move to smaller flats or make use of the Silver Housing Bonus and the Lease Buyback Scheme” (The Manpower Blog: “The Truth About Our CPF and the Minimum Sum“, May 25)

Schemes that “take away” your HDB value?

– Are there any countries in the world that “takes away” the equity of the homes of particularly its lower-income citizens?

When you opt for the Lease Buyback Scheme – are you not in a sense, giving up the future appreciation of the value of your HDB flat in exchange for a 30-year lease to continue staying in your flat plus a monthly fixed income (not indexed for inflation) for life under the CPF Life scheme?

When you opt to downgrade to a HDB Studio flat – are you not in a sense paying a relatively high price (relative to say a 2-room 99 year lease HDB flat of about the same size) for a 30-year lease which has no resale value?

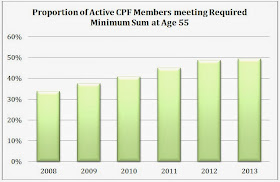

49% met Minimum Sum?

With regard to “About half of active CPF members are able to now, compared to one third just five years earlier.

The article “Degree holders ‘most vulnerable’ to retrenchment” on the same day (Straits Times, May 26) seems to indicate that the more educated you are, the easier it may be for you to lose your job, and the harder and longer it may take to find another one.

So, if you lose your job and have difficulty finding another suitable job – not to mention the widespread age discrimination and competition from foreign workers – and you can only withdraw $5,000 at age 55 because you don’t meet the ever increasing Minimum Sum – life may be hard for you and your family.

Do not spend a single cent on CPF?

Finally, by the way – from a cashflow perspective – does the Government spend any money at all on CPF, HDB and healthcare?

SY Lee and Leong Sze Hian

+Proportion+of+active+CPF+members+meeting+MS.jpg)