Why no more statistics on how many were able to meet the CPF Full Retirement Sum at age 55?

I refer to the article “MOF press secretary lied about our failed CPF scheme” (likedatosocanmeh, Jun 16, 2018).

It states that “In “Plain speech also about telling the hard truth“, MOF press secretary Lim Yuin Chien must have thought Singaporeans are dumbasses when he anyhow claimed that “the Central Provident Fund scheme is adequate for most Singaporeans“.

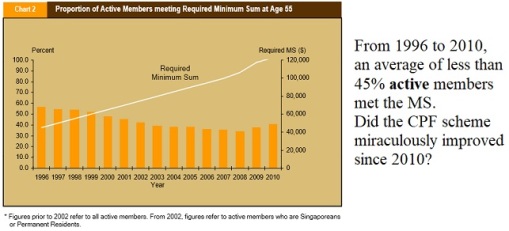

In an ST article 4 years ago, Associate Professor of Economics at NUS Chia Ngee Choon told readers that “half of CPF members are unable to meet the MS (Minimum Sum) at 55“.

Chia was likely to have been referring to the number of “active members“, a higher figure when compared with “all members” which includes tens of thousands of housewives who had not worked for decades.

3 years earlier, the CPF Board had already own self confirmed own failure: “Among the active members who reached 55 years old in 2010, about 40.7% met the required MS” of $123,000. (see CPF Trends Feb 2011)”

In this connection, according to the article “Number of 55-year-olds with Basic Retirement Sum to go up” (Business Times, Mar 7, 2017) – “SIX in 10 active Central Provident Fund (CPF) members now accumulate enough savings for their Basic Retirement Sum account when they turn 55. The number, first achieved in 2013, is likely to rise to seven in 10 for members turning 55 in 2020”.

Met with property pledge?

What may be interesting to note is that in the past, we used to talk about the statistics of those who were able to meet the CPF Minimum Sum (without property pledge), but now we seem to be only talking about the Basic Retirement Sum (BRS) (with property pledge).

How many self-employed?

In this connection, since according to the last available statistics that I can find – “23 per cent of Singaporeans who turned 55 in 2013 were inactive CPF members, while the remaining 77 per cent were active members or self-employed” – if 10 per cent of the 77 per cent “active members” were self-employed – then the number who met the Minimum Sum with property pledge was estimated to be 40.2 per cent (60% of the 67% active members).

Only 1 in 5 Singaporeans met Minimum Sum at 55?

So, does it mean that the number who met the Minimum Sum entirely with CPF is estimated to be 20.1 per cent (40.2 x 0.5) – if we assume that the past statistics (can’t find now) still holds true?

Why not just or also tell us how many Singaporeans met the Minimum Sum (now called the Full Retirement Sum) in full at age 55?

Use of CPF for HDB?

As to “Among CPF members who turned 55 years old over the past five years and had used CPF monies to purchase HDB flats, an average of 55 per cent of their Ordinary Account savings had been withdrawn to finance their flats at age 55” – with the continuing rise of HDB prices – how many Singaporeans will have the FRS of $171,000 now and increasing by 3 per cent per year to $181,000 in 2020?

Leong Sze Hian